Allied in the News

AlliedFCU Staff Donate $600 to Meals on Wheels of Tarrant County, Commit to Delivering Meals Weekly

May 20, 2025

AlliedFCU donated $600 to Meals on Wheels of Tarrant County recently and committed to a weekly meal delivery route. Employees will take turns delivering meals to homebound, elderly and disabled Arlington and Mansfield residents.

AlliedFCU Staff Donate $600 to Arlington Charities to Fight Food Insecurity in the Community

April 17, 2025

AlliedFCU recently donated $600 to Arlington Charities to support the organization’s mission of providing nutritious groceries and free educational classes to individuals and families in need. As the largest provider of supplemental food assistance in the city, Arlington Charities plays a vital role in helping community members move toward greater stability and self-sufficiency. The donation was made by AlliedFCU employees through its Casual for a Cause program.

allied FCU STaff donate $600 to harvesting in Mansfield

March 5, 2005

AlliedFCU donated $600 to Harvesting in Mansfield (HIM) last week, helping support the non-profit’s mission of creating a hunger-free world. HIM serves roughly 100,000 people in more than 25 counties, looking for lasting ways to improve the lives of impoverished children and families. AlliedFCU’s $600 donation amount is a nod to the credit union’s 60-year anniversary this year. The money is donated by employees through their Casual for a Cause program.

Allied FCU Donates $600 to Hagar's Heart to Support domestic violence survivors

Allied Federal Credit Union recently donated $600 to Hagar’s Heart, a local organization that empowers domestic violence survivors through self-care, aiming to help them restore their self-worth during their recovery journey. Hagar’s Heart has helped more than 6,800 domestic violence survivors since May 2020.

letters to santa brought christmas wishes to life for AlliedFCU members

Spreading joy is what the Christmas season and our Letters to Santa program is all about. In 2024, Letters to Santa spread joy to four AlliedFCU families. Thank you to everyone who wrote a letter to Santa last year.

AlliedFCU Donates $515 to Mansfield Mission Center

See a need. Fill a need. That’s how AlliedFCU operates, and it sure came in handy this month for the Mansfield Mission Center. The credit union donated $515 to the center after seeing a social media post about donations needed for the food pantry.

AlliedFCU Partners with Arlington PD, Donates $800 to Purchase gifts for Children

Allied Federal Credit Union supported the Arlington Police Department’s “Santa Cops” program with an $800 donation this year – an even larger donation than they made last year. It’s an annual tradition for AlliedFCU to support the “Santa Cops” program, which partners with the Arlington Independent School District to spread Christmas cheer to families without the means to do it themselves. Program highlights include buying gifts for children and hosting a Christmas party for their families.

Allied FCU Has Another Successful “Socktober,” Donates $720 and 273 pairs of Socks to Homeless in Community

Allied Federal Credit Union celebrated “Socktober” again by donating 273 pairs of socks and $720 to Mission Arlington. This national movement calls on Americans across the country to donate new socks to local shelters and other organizations that work with less fortunate people. This is the third year AlliedFCU has participated in “Socktober.”

AlliedFCU Members and Employees Support Local Children, Donate Supplies and $1,400 to Four Schools

Allied Federal Credit Union staff and members donated school supplies throughout the summer at AlliedFCU branches to help four local schools provide these supplies to students who may not be able to afford them.

alliedfcu makes donation to arlington charities

Allied Federal Credit Union recently donated $500 Arlington Charities to help feed families during the summer who normally rely on free and reduced lunches during the school year.

AlliedFCU Celebrates National Animal Care and Control Week with Donations to Arlington and Mansfield Animal Services

Allied Federal Credit Union donated $680 to animal services in Arlington and Mansfield as part of Animal Care and Control Week. This week celebrates animal control officers and all they do to help vulnerable pets. Each shelter received $340. AlliedFCU also encouraged its members to donate to the shelters’ Amazon wish lists and adopt pets as well.

ALLIEDFCU STOCKS LITTLE LIBRARIES WITH NEW BOOKS IN CELEBRATION OF READ ACROSS AMERICA DAY

Allied Federal Credit Union celebrated Read Across America Day this year by donating books to little libraries across the Arlington and Mansfield communities. Little libraries are collections of books usually located in some type of display outside homes or gathering places. As people pass by, they are free to browse the collection and take a book and can even add a book.

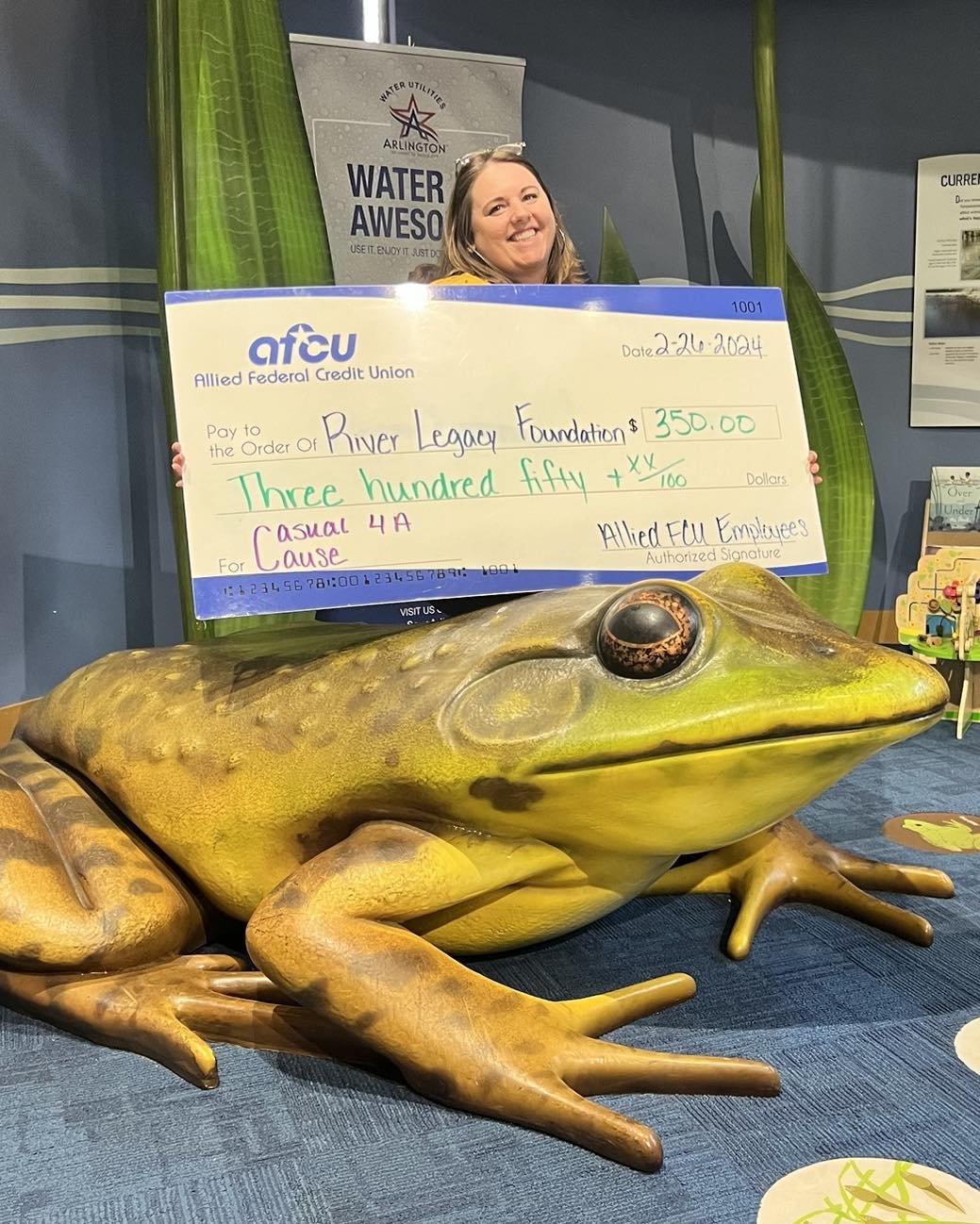

AlliedFCU donates $350 to the River Legacy Foundation, Keeps Exploration Alive

Allied Federal Credit Union recently donated $350 to the River Legacy Foundation as part of the Credit Union’s Casual for a Cause program. This donation will help the Foundation keep exploration and adventure alive for the Arlington community. The River Legacy Foundation cares for wildlife, pays for visiting exhibits and funds school field trips.

ALLIEDFCU KICKS OFF NEW YEAR WITH KINDNESS, DONATES $300 TO THE MIRACLE LEAGUE DFW

Allied Federal Credit Union started the new year by donating $300 to The Miracle League DFW. This organization provides children and young adults the opportunity to play baseball regardless of their abilities. The Miracle League removes barriers that prevent children with mental and physical disabilities from experiencing team sports.

AlliedFCU Members Receive Gifts and Gift Cards As Part of “Letters to Santa” Program

Writing letters to Santa was no longer a childhood memory for AlliedFCU members this holiday season. Members addressed letters to Saint Nick himself before requesting their Christmas wishes. Then, the elves at AlliedFCU chose letters at random and granted those writers’ Christmas wishes.

Allied FCU Partners with Arlington PD, Donates $750 for Purchase of Children’s Gifts

November 3, 2023

This November, Allied Federal Credit Union supported the Arlington Police Department’s “Santa Cops” program with a $750 donation. The “Santa Cops” program partners with Arlington Independent School District to spread Christmas cheer to families who can’t afford the festivities.

Allied FCU Recognizes “Socktober,” Donates $530, Nearly 300 pairs of Socks to Community’s Homeless

October 26, 2023

You know you’ve collected a lot of socks when you can bury one of

your employees in them. Thank you members and staff.

Allied Federal Credit Union donated nearly 300 pairs of socks and $530 to Mission Arlington through its participation in “Socktober.” This national movement calls on Americans across the country to donate new socks to local shelters and other organizations that work with homeless. This year marks the second year AlliedFCU has participated in “Socktober.”

AlliedFCU Staff and Members Empower Children, Donate School Supplies and $1,300 to Local Schools

August 31, 2023

Allied Federal Credit Union staff and members donated school supplies throughout the summer at all AlliedFCU branches to help local students in need. Credit Union staff delivered them to 4 schools throughout Arlington and Mansfield. These schools also received a total of $1,300 as part of AlliedFCU’s Casual for a Cause program.

Read More

Allied FCU Community Feeds Hungry Children, Donates Food and $746 to HIM and Arlington Charities

June 30, 2023

Allied Federal Credit Union employees and members recently donated hundreds of non-perishable food items and a total of $746 to Harvesting in Mansfield (HIM) and Arlington Charities. Both charitable organizations run food banks to help feed children and families without access to free and reduced lunches during the summer months. AlliedFCU collected kid-friendly food items at each of its credit union branches, and credit union employees donated around $373 to each charity as part of the Casual for a Cause program.

Allied FCU Employees, Family Members Participate in St. Paddy’s

Parade 5k and Support Children in Need

March 20, 2023

Allied Federal Credit Union employees and their family members participated in a 5K Walk/Run for the World’s Only St. Paddy’s Pickle Parade and Palooza in Mansfield, Texas. The event is organized by a volunteer non-profit group, which provides college scholarships through the Mansfield ISD Education Foundation Scholarship Program. It also donates money to the Feed the Kids program. Read More

AlliedFCU Recognizes Poverty Awareness Month, Donates 20 Cereal Boxes and $334.95 to Local Food Bank

January 2023

In January, Allied Federal Credit Union employees recognized Poverty Awareness Month by donating boxes of cereal and $334.95 to Harvesting in Mansfield.

ALLIEDFCU MEMBERS WRITE “LETTERS TO SANTA,” CREDIT UNION GRANTS CHRISTMAS WISH TO ONE MEMBER PER BRANCH

January 1 , 2023

Allied Federal Credit Union members spent the early holiday season writing “Letters to Santa,” which they dropped off at the Credit Union’s branches. In the letters, members requested a gift they wanted for Christmas. Credit Union staff then selected one letter from each branch and granted that member’s holiday wish. This initiative focused on allowing the Credit Union to give back to it’s members who give AlliedFCU so much throughout the year.

AlliedFCU Gives $500 to “Santa Cops,” Works with Arlington PD to Gift Children Holiday Cheer

December 1, 2022

Allied Federal Credit Union staff donated $500 to the Arlington Police Department’s “Santa Cops” program this November. “Santa Cops” works alongside Arlington Independent School District to locate children in need, buy them gifts and throw a Christmas party for their families. The donation was part of the Credit Union’s Casual for a Cause program.

Allied FCU Participates in “Socktober,” Donates 500 Pairs of Socks and $300 to Individuals in Need

October 27, 2022

This October, Allied Federal Credit Union donated 500 pairs of socks and presented a check for $300 to Mission Arlington, a local organization providing supplies and services to those in need. Credit Union employees chose to support Mission Arlington as part of “Socktober,” a wider movement calling on organizations to provide socks to the homeless as the weather gets colder.

Allied FCU Employees Help Local Domestic Violence Victims, Give $380 to SafeHaven of Tarrant County

September 27, 2022

Allied Federal Credit Union employees donated $380 to assist SafeHaven of Tarrant County this month. SafeHaven of Tarrant County helps domestic abuse victims escape violent situations and empowers them to leave abusive relationships.

Allied FCU Staff and Members Donate School Supplies and $300 Each to Three Local Schools

August 22, 2022

Allied Federal Credit Union members and staff donated $900 and school supplies last week to three local schools with a high population of economically disadvantaged children. Credit Union employees delivered those donations to Erma Nash Elementary, Webb Elementary and Williams Elementary.

Allied Staff Raise Nearly $270 for Arlington Life Shelter, Support Homeless on Path to Self-Sufficiency

June 15, 2022

This June, Allied Federal Credit Union employees donated $266.28 to help the city’s homeless at the Arlington Life Shelter. This shelter provides food, housing and education to guide homeless families back to financial independence. Staff donations were part of the Credit Union’s Casual for a Cause program.

Allied FCU’s Great Gas Giveaway Helps Arlington, Mansfield Residents Pay for over $1,000 in Fuel

May 2022

Allied Federal Credit Union employees distributed gas cards at gas stations in the Arlington-Mansfield area. They randomly chose gas station customers and surprised them with $15 gas cards to help make their trips a little cheaper. Allied FCU and its employees donated over $1,000 to pay for the gas cards as part of the credit union’s Casual for a Cause program.

Allied FCU Staff and Members Donate $250, Supplies to Local Animal Shelters

April 26, 2022

Allied Federal Credit Union employees donated $250 through their Casual for a Cause program, and employees and members donated pet supplies to City of Arlington Animal Services and City of Mansfield Animal Care and Control for Animal Care and Control appreciation week. Both shelters improve the lives of animals by providing humane care and placing them in good homes. Read More

Allied FCU Employees, Family Members Participate in St. Paddy’s Parade 5k and Support Children in Need

March 31, 2022

Allied Federal Credit Union employees and their family members participated in a 5k Walk/Run for the World’s Only St. Paddy’s Pickle Parade and Palooza in Mansfield, Texas. The event is organized by a volunteer non-profit group, which provides college scholarships through the Mansfield ISD Education Foundation Scholarship Program. It also donates money to the Feed the Kids program. Read More

Allied FCU Staff Donate $340 to Arlington’s Care and Share Program, Pay Water Bills For Those In Need

March 3, 2022

Allied Federal Credit Union staff paid $340 worth of water bills for financially struggling Arlington residents as part of the city’s Care and Share Program. Arlington Care and Share uses private donations to pay water bills for those in need and has helped hundreds of families to date. The $340 donation came from Allied FCU’s Casual for a Cause program.

Allied FCU Staff, Members Donate Nearly 400 Pounds of Food and $360 to Local Nonprofits

February 7, 2022

A food drive organized by employees of Allied Federal Credit Union in December through January, collected 394 pounds of food – 555 items - for local charities. Allied FCU donated 284 pounds of food to Arlington Charities. The other 110 pounds went to Harvesting in Mansfield. Both organizations also received a check for $180 raised through the credit union’s Casual for a Cause program.

Allied FCU Staff, Members Donate More than 100 toys and several hundred dollars to Marine Toys for Tots

January 24, 2022

Allied Federal Credit Union donated 138 new toys to Marine Toys for Tots last month, helping the organization deliver hope to less fortunate children for the holidays. The new, unwrapped toys were donated by employees and members at all three branch locations.

Employees donated money all month long to provide gifts for children in need during the holiday season

December 1, 2021

Allied Federal Credit Union’s employees recently donated $445.25 to their local Santa Cops program – a partnership between the Arlington Police Department, the Arlington Police Foundation and the Arlington Independent School District. The program provides toys and other supplies to children in need during the holidays.

"Here at Allied, we are well aware of the struggles and hardships families are faced with each holiday season,” said Jordanne Roper, teller and Casual for a Cause committee member. “Even more so considering the recent impact on the economy…

ALLIED FEDERAL CREDIT UNION STAFF DRESS CASUAL TO SUPPORT FIRE PREVENTION

November 15, 2021

Employees of Allied Federal Credit Union donated $150 worth of batteries to the Mansfield Fire Department in October for Fire Prevention Month. The batteries will be used for replacement smoke detectors throughout the community.

Every month, Allied FCU employees pay money to wear casual clothing as part of the credit union’s community outreach initiative…

EMPLOYEES RAISE $290 TO HELP PROVIDE POSITIVE MALE ROLE MODELS IN THE ARLINGTON/MANSFIELD COMMUNITY

October 12, 2021

AlliedFCU's staff is committed to helping the community in which they serve. Through their Casual for a Cause initiative, employees are invited to pay to dress casually during the month to support organizations within these communities. In September Allied FCU raised and donated $290 towards the NEX Foundation.

ALLIED FEDERAL CREDIT UNION MEMBERS, EMPLOYEES DONATE SCHOOL SUPPLIES AND MONEY TO LOCAL SCHOOLS IN NEED

September 20, 2021

Allied Federal Credit Union, with the help of its member and employees, donated school supplies and $655.11 to three local elementary schools – two in Arlington and one in Mansfield. The credit union ran a school supply drive in July and August, asking members to bring in supplies. Those supplies were recently delivered to Erma Nash Elementary, Webb Elementary and Williams Elementary. Each school also received a check for $218.37. The money was raised by Allied employees, who made a monetary donation in exchange for dressing casual at work. . .